NetLink NBN Trust – Higher Rates Start to Bite

traderhub8

Publish date: Thu, 23 May 2024, 11:01 AM

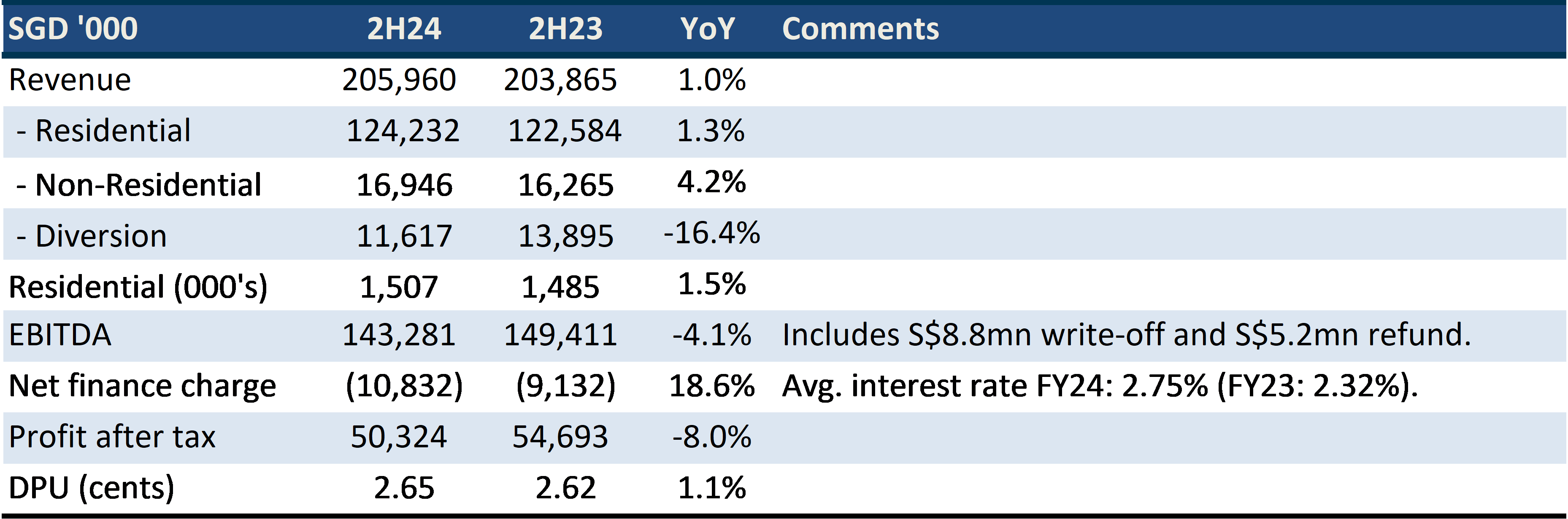

- 2H24 results were within expectations. FY24 revenue and EBITDA were 98%/97% of our FY24e forecast, respectively. Final DPU increased 1.1% YoY to 2.65 cents (FY24: 5.3 cents).

- 2H24 revenue was negatively impacted by a 16% decline in diversion revenue. EBITDA was weaker due to the S$8.8mn decommissioned asset write-off offset by a power charge refund of S$5.5mn. Residential connections recovered in 2H24 to annualised 21,726 (FY23: 21,054).

- FY25e cash-flows will be negatively impacted by the lower residential connection charges (from S$13.80 to S$13.50), elevated capex for a new central office, and higher interest rates. Our target price of S$0.87 and NEUTRAL rating are unchanged. The current distribution is sustainable, with the ability to tap on additional borrowings. Interest rate pressure on cash flow will persist, especially in FY26, when interest rate hedges on a substantial portion of the debt are unwound.

Results at a glance

The Positive

+ Rebound in residential connection. 2H24 net adds recovered 15,334 connections after the weak 1H24 of 6,392. Connection in FY24 was 21,726 and within our expectations of 22,000 per year or household formations per year. Connections are volatile on a quarterly basis due to the timing in the availability of sites.

The Negative

– Finance cost rose 19% YoY. Higher effective interest rate of 2.75% push interest expenses up by 19% to S$10.8mn. Netlink has raised its hedged debt to 78% in FY24 (FY23: 69%). We believe this resulted in some hedging gains, especially in 3Q24. With the elevated capex for the new central office in Seletar, interest expenses will remain a drag on DPU.

Source: Phillip Capital Research - 23 May 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024