Singapore Banking Monthly – Interest Rates Inch Up

traderhub8

Publish date: Thu, 06 Jun 2024, 05:05 PM

- May’s 3M-SORA was up 2bps MoM to 3.68% and 2bps higher than the 1Q24 average. Furthermore, the 3M-SORA rose by 6bps YoY. 3M-HIBOR was up 13bps MoM to 4.67%, reversing the decline of 16bps in April.

- Singapore domestic loans inched up 1.5% YoY in April, the largest YoY increase since October 2022. We expect low-single-digit growth for 2024 as loan growth is expected to continue to be positive going into 2H24. The CASA balance was maintained at 18.3% (Mar24: 18.3%).

- Maintain OVERWEIGHT. Banks continued their positive performance in May performance. The best performer continued to be DBS, with a 3% increase, while OCBC and UOB improved by 2% and 1%, respectively. We remain positive on banks. NIMs may stay flat despite the higher-for-longer interest rate environment. A recovery in loan growth and fee income will lift profits. Bank dividend yields are attractive at 6.1%, with upside surprises due to excess capital ratios and a push towards higher ROEs.

3M-SORA and 3M-HIBOR tick up in May

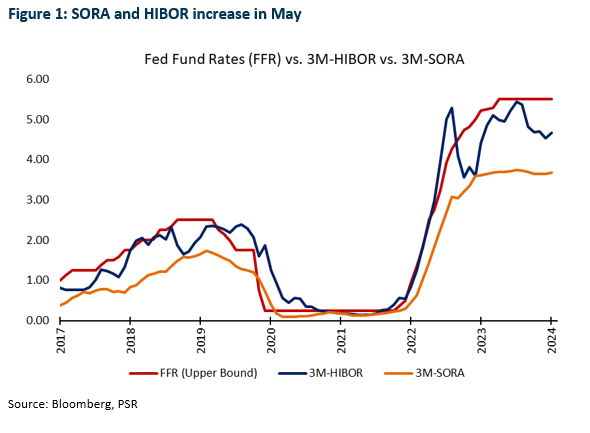

Singapore interest rates were up 2bps to 3.68% in May, rising for two consecutive months in 2024. May’s 3M-SORA rose by 6bps YoY and was 2bps higher than the 1Q24 3M-SORA average of 3.66% (4Q23: 3.74%). Notably, this is the second smallest YoY increase since March 2022.

Hong Kong interest rates recovered slightly in May. The 3M-HIBOR was up 13bps MoM to 4.67%, slightly reversing the decline of 16bps in April. May’s 3M-HIBOR improved by 26bps YoY but was 6bps lower than 1Q24 3M-HIBOR average of 4.73% (Figure 1).

Singapore loan growth positive, largest since Oct 2022

Overall loans to Singapore residents – which captured lending in all currencies to residents in Singapore – rose by 1.5% YoY in April to S$804bn. Notably, this is the largest YoY increase since October 2022. We expect low-single-digit growth for 2024 as loan growth is expected to continue to be positive going into 2H24.

Business loans rose by 1.8% YoY in April. Loans to the building and construction segment, the single largest business segment, grew 0.1% YoY to S$169bn, while loans to the manufacturing segment fell 12% YoY in April to S$21bn.

Consumer loans grew 1% YoY in April to S$312bn, the fourth consecutive YoY increase recorded since December 2022. Housing loans, which comprise ~70% of consumer lending, grew 1.3% YoY in April to S$225bn.

Total deposits and balances—which include deposits in all currencies made by non-bank customers—grew by 5% YoY in April to S$1,851bn. In the Current Account and Savings Account, or CASA, the proportion maintained at 18.3% (Mar24: 18.3%) of total deposits or S$339bn.

Source: Phillip Capital Research - 6 Jun 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024