Valuetronics Holdings Ltd- Get Paid as Customer Base Is Refreshed

traderhub8

Publish date: Mon, 03 Jun 2024, 11:20 AM

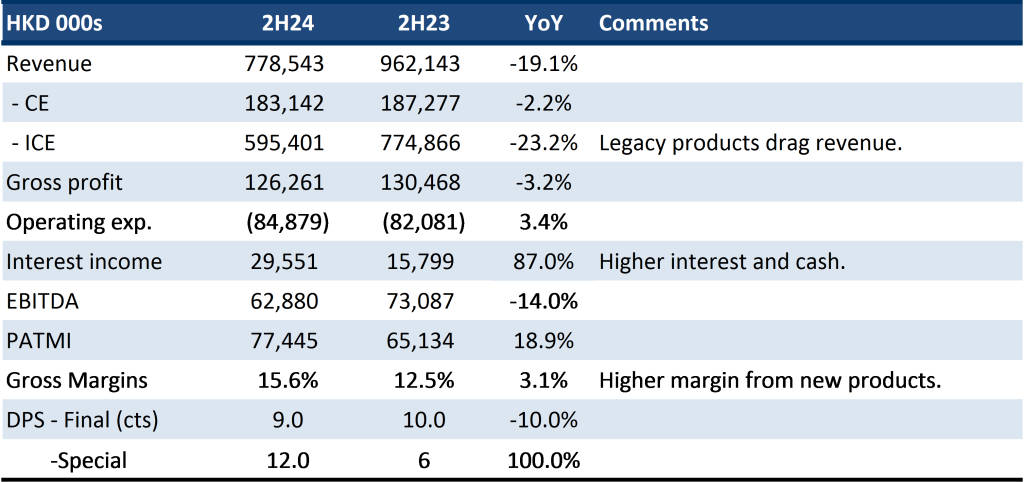

- FY24 revenue was below our estimates at 89% of FY24e forecasts. PATMI was better than expected at 105% of our FY24e forecast. Lower depreciation, effective tax, and higher interest income were the reasons for the outperformance.

- Revenue was weaker than expected due to drag in legacy products such as consumer product printed circuit board assembly (PCBA) and auto entertainment modules. Customers have permanently switched their supply chains out of China. Contributions from new customers, namely networking products and theme park entertainment devices, are commencing.

- 2H24 earnings growth of 19% YoY to HK$77mn was due to higher gross margins and a doubling of interest income. We kept our FY25e PATMI unchanged. Our target price is raised from S$0.70 to S$0.76 as we roll over our valuations to FY25e earnings. We peg our target price to the industry valuation at 11x PE. We believe Valuetronics is turning around its operation with its new customers. The pace of the turnaround will still be constrained by some remaining legacy products. Meanwhile, valuations remain attractive with their cash pile of HKD1.16bn (or S$200mn). Around 80% of the market capitalisation is net cash. The company is also aggressively returning capital. Dividends including special were raised by 25% to HKD0.25 (dividend yield of 7%) and an outstanding share buyback plan of HKD171mn (or ~46mn shares at current share price). Company trading at EV/EBITDA of 1.7x FY25e.

Source: Company, PSR #CE – consumer electronics, ICE – industrial and commercial electronics

The Positives

+ Higher gross margins. Gross margins expanded by 3% points YoY to 15.6%, the highest in three years. New products, weak renminbi, falling depreciation and less (spot) pricy electronic components are driving up margins. Net margin was also boosted by the overprovision of taxes in 1H24, lower depreciation and interest income is not taxable.

+ Robust free cash flows and returning more to shareholders. Free cash in FY24 was HK$212mn (or S$36mn), an improvement over FY23’s HK$163mn (S$28mn). Including special dividends, Valuetronics is paying 25 cents (or S$18mn), a 25% rise from FY23. Capital expenditure will remain low at HK$20mn. This after the massive capex spend of around HK$90mn p.a. for three years in FY20-22 on a new Vietnam factory.

The Negative

– Weakness in revenue. 2H24 revenue declined 19% YoY to HK$778mn. The biggest drag to revenue was the 23% YoY fall in ICE. Two legacy products – household consumer and auto – are fading out due to the supply chain exiting from China to Indonesia and North America, respectively. Another weak category is printers due to excess inventory post-pandemic.

Outlook

We expect revenue and margins to improve as new customer contributions increase. For new customer ramps to be meaningful, they require at least two years. Weak macro may delay the launch of some products (Figure 1) and cause customers to keep leaner inventory levels. However, we also expect Valuetronics to add more new customers with their excess capacity in Vietnam.

Figure 1: Four new customers to support growth

Product | Comment |

1. Electronic products used in theme parks

| Sales are expected to pick up in FY25, especially if a new series of products is introduced. Demand is captive because it is used in their customer’s amusement parks and is not dependent on global macro conditions. Contributed in 2H24 and expected to contribute to full-year revenue in FY25.

|

2. Network access solutions provider based in Canada | There is healthy visibility of orders. Demand for more secure networking products is pushing up demand. Contributed in 2H24 and expected to contribute to full-year revenue in FY25.

|

3. Electronic tags in retail stores | Demand is slower than expected. End customers, such as supermarkets in Europe, are holding back their capital investment plans.

|

4. Liquid cooling system for gaming PC | Delay in major ramp and as the development cycle for new products is longer than expected.

|

Source: Company, PSR

Maintain BUY with a higher TP of S$0.76 (prev. S$0.70)

Our target price is based on industry valuations of 11x PE 1-year forward earnings. Excluding cash, the company is trading at 3x historical PE and 1.7x EV/EBITDA FY25e.

Source: Phillip Capital Research - 3 Jun 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024