LHN Limited – Co-living Profits Tripled, More Growth Expected

traderhub8

Publish date: Thu, 23 May 2024, 11:00 AM

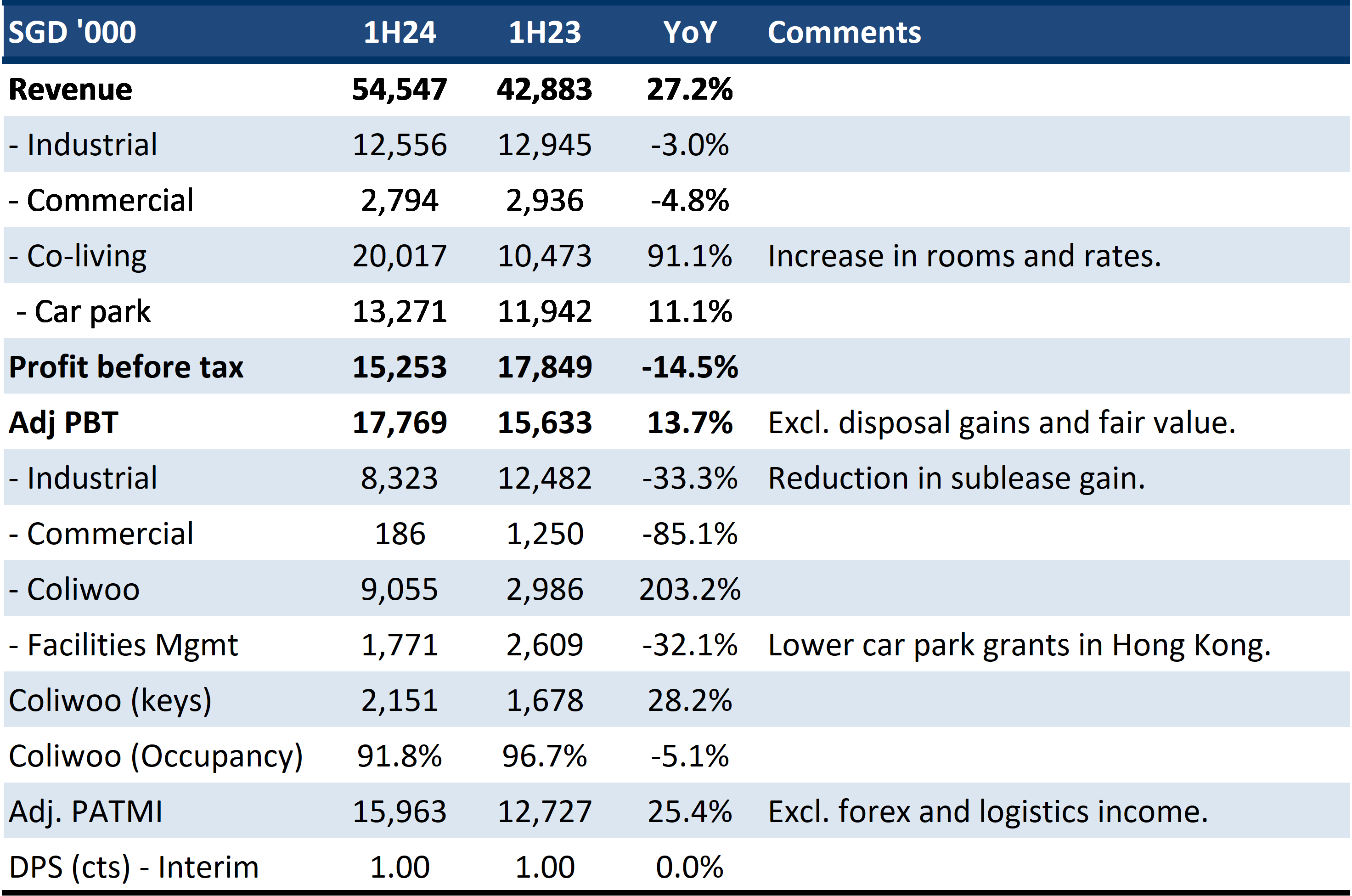

- 1H24 revenue was within expectations, but earnings exceeded. Revenue and adjusted PATMI were 51%/65% of our FY24e forecast, respectively. Margins for co-living were higher than expected due to the high occupancy and room rates.

- 1H24 adj. PATMI rose 25% YoY to S$16mn. Growth was driven by co-living revenue doubling and earnings tripled to S$9mn. The number of keys rose 28% YoY to 2,151, but occupancy dipped 5% points to 92%. We believe room rates rose around 70% YoY due to the commencement of Coliwoo Orchard and the overall health of the residential rental market. Coliwoo has also started to manage 3rd party properties. LHN targets to grow co-living by 800 keys every year.

- We raised our FY24e earnings by 7% to account for the better-than-expected earnings from Coliwoo. Our target price is raised from S$0.39 to S$0.42. We peg our valuations to 6.5x FY24e P/E, while the industry is trading around 13x. We expect growth to remain stable for LHN in 2H24, supported by stable room rates. FY25e will be a banner year of growth. The number of keys in co-living will expand by at least 900 (187 in Coliwoo GSM Building and 700 healthcare professionals). In addition, the sale of 49 food processing industrial units will be another one-off gain from the property development business. We maintain our BUY recommendation. The Coliwoo franchise is scaling up and expanding into 3rd party management contracts. The stock pays a dividend yield of 6% and trades at a PE of 5.2x and 40% discount-to-book value of S$0.55.

Results at a glance

The Positive

+ Stellar earnings for Coliwoo. Co-living profit before tax tripled in 1H24 to S$9mn. Revenue growth of 91% YoY to S$20mn was supported by 28% growth in keys to 2,151 and an estimated 70% jump in room rates to S$1,900 per month. The commencement of the 411 keys in Coliwoo Orchard in Feb 23 was a major boost to room rates. The residential rental index in Singapore is up 33% over the past 2-years but has started to stabilise.

The Negative

– Weaker facilities management earnings. Facilities management earnings declined 32% YoY to S$1.7mn despite revenue growth of 14% YoY to $17.2mn. The number of car parks under management rose from 74 (~20k lots) to 81 (~25k lots). We believe the margin weakness was due to a loss of government grants. Nevertheless, the number of car park lots will grow with the recent contract award of another 900 car park lots.

Source: Phillip Capital Research - 23 May 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024