Trader Hub

Thai Beverage PLC – Beer Turning Fresh

traderhub8

Publish date: Thu, 16 May 2024, 04:33 PM

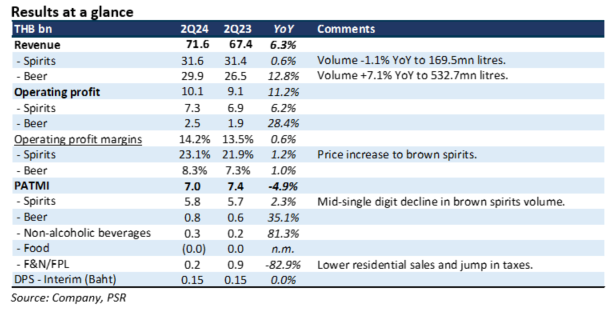

- Results were within expectations. 1H24 revenue and PATMI were at 50%/53% of our FY24e forecasts. Margins are ahead of expectations, but associate profit fell 83% YoY on weaker property sales and higher taxes.

- After four quarters of decline, beer volumes have started to rebound. 2Q24 volumes jumped 12.8% YoY to 532.7mn litres. Growth was in both Vietnam (+6.4%) and Thailand (+8.2% YoY). Beer volumes are still 20% below pre-pandemic.

- We lower our FY24e PATMI by 4% to THB27.8bn to account for lower associate earnings. Our BUY recommendation is maintained, but the target price has been cut to S$0.63 (prev. S$0.67). We revised our foreign exchange assumptions lower and accounted for the lower associate market capitalisation, which was unchanged. We peg our target price to 16x FY24e core earnings, the 3-year historical average. Listed associates are valued at market valuations with a 20% discount. We expect beer volumes to recover further as macro conditions and consumer spending rebound in Thailand and Vietnam. Aggressive government stimulus in Thailand will provide an added spurt in consumption.

The Positive

+ Beer volume recovery. There was a significant turnaround in beer volumes. After four quarters of decline, beer volumes rebounded on market share gains, warmer weather, more marketing events, a higher number of tourists, and overall improvement in macro conditions.

The Negative

– Associate earnings collapse. Associate earnings are volatile due to the lumpiness in residential property project earnings and fair value changes. Fraser’s property earnings were hurt by a reduction in residential revenue in Singapore and Thailand and higher taxes.

Source: Phillip Capital Research - 16 May 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

CSOP IEdge S-REIT Leaders Index ETF – The Deeper Discounted Singapore REIT ETF

Created by traderhub8 | Jun 12, 2024

Valuetronics Holdings Ltd- Get Paid as Customer Base Is Refreshed

Created by traderhub8 | Jun 03, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments