SASSEUR REIT – FY24e Sales Will be Driven by Promotional Events

traderhub8

Publish date: Wed, 15 May 2024, 10:54 AM

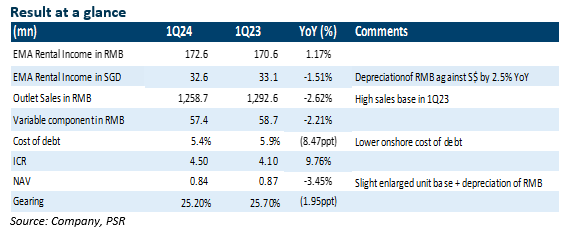

- 1Q24 rental income in SGD terms was within expectations at 25% of our FY24e estimates (S$32.6mn, -1.4% YoY, +1.2% YoY in RMB), representing a S$0.5mn YoY decrease due to the weakening RMB against the S$ by 2.5%.

- Outlet sales in RMB were 24% of our estimate (RMB 1258.7mn, -2.6% YoY), leading to a 2.2% YoY decrease of the variable component as 1Q23 had a high base post-reopening of China after the pandemic. The REIT has changed to a half-yearly dividend distribution.

- We reiterate our BUY recommendation with an unchanged DDM TP of S$0.87. FY24e – FY25e DPU forecast is lowered by 1% to 6.31-6.67 Singapore cents after factoring in a weaker RMB against the Singapore dollar. Leveraging on the high customer loyalty and series of promotional events in FY24e, we believe sales are able to grow in the low teens.

The Positive

+ Raising VIP member base. VIP members increased by 19.5% YoY to 3.7mn, and contributed 60% of the 1Q24 outlet sales. Although Q2 is usually seasonally weaker, SASSR observed footfall during the Golden Week (Labor Day) increased by c.8%, and there’s also a line of sales events such as the Mid-Year sales in June to promote tenant sales.

The Negative

– Outlet sales slid by 2.6% YoY to RMB 1258.7mn due to pent-up demand in retail spending in 1Q23 following the reopening of the economy. We also attribute the decline to seasonality, as there are large-scale events like the Red Festival and year-end promotions. Winter merchandise generally has a higher value, boosting sales in Q4, while in 1Q, sales were mainly of lower-value spring merchandise.

Source: Phillip Capital Research - 15 May 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024