Oversea-Chinese Banking Corp Ltd – Non-interest Income the Growth Driver

traderhub8

Publish date: Mon, 13 May 2024, 11:14 AM

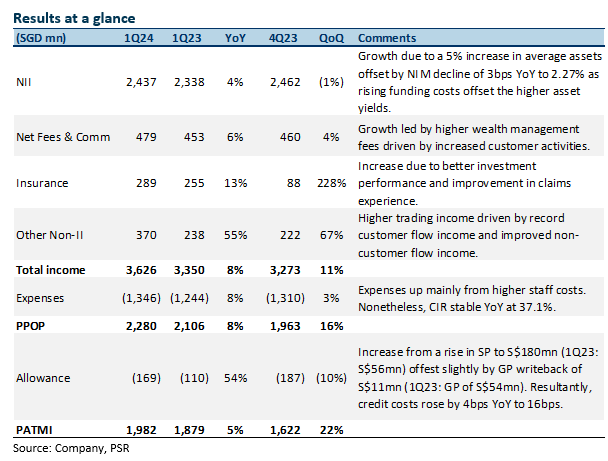

- 1Q24 earnings of S$1.98bn were slightly above our estimates. This was due to higher non-interest income from growth in fee, insurance, and trading income and moderate growth in NII offset by higher allowances and expenses. 1Q24 PATMI was 28% of our FY24e forecast.

- NII grew 4% YoY from loan growth of 2% YoY offset by NIM dipping 3bps YoY to 2.29%. Total non-interest income rose 17% YoY, led by broad-based growth from fee, trading, and insurance income. Allowances rose 54% due to higher SPs offset by lower GPs as credit costs rose 4bps YoY to 16bps.

- OCBC also announced a S$1.4bn voluntary unconditional general offer for the remaining 11.56% stake in Great Eastern Holdings Limited (GEH) that it does not own. The offer price was S$25.60 per share.

- Downgrade to Accumulate with a higher target price of S$15.40 (prev. S$14.96) as we account for recent share price performance and increase FY24e earnings by 2%. We raise our NII estimates from higher NIMs. We assume 1.33x FY24e P/BV from a higher ROE estimate of 13.0% (prev. 12.8%) in our GGM valuation. We expect FY24e earnings to grow from double-digit fee income recovery and stabilised provisions. NII will remain flattish as stable loan growth from rate cuts expected in 2H24 will be offset by moderating NIMs. We like OCBC due to attractive valuations and a dividend yield of 6.2%, buffered by a well-capitalised 16.2% CET 1, and non-interest income growth from recent acquisitions.

The Positives

+ Non-interest income rises 17% YoY. The growth was broad-based from fee income, trading income and insurance income. Fee income was up 6% YoY mainly due to growth in wealth management fees (+20% YoY) offset slightly by lower loan and trade-related fees (-6% YoY), lower brokerage and fund management fees (-5% YoY) and stable investment banking fees. Trading income rose 45% YoY to a quarterly high of S$370mn from record customer flow income and improved non-customer flow income, while insurance income was up 13% YoY. The Group’s total wealth management income (consisting of S$873mn in banking and S$416mn in insurance) for 1Q24 grew 19% YoY and contributed 36% to the Group’s total 1Q24 income (1Q23: 32%). OCBC’s wealth management AUM was 1% higher YoY at S$273bn driven by continued net new money inflows of S$6bn for the quarter.

+ Net interest income up slightly. NII rose by 4% YoY to S$2,437mn; the growth was led by a 5% increase in average assets, which was offset slightly by NIM moderating by 3bps YoY to 2.27%. NIM moderation was mainly from higher funding costs, which offset the increase in asset yields. Loans grew 2% YoY to S$297bn from an increase in both corporate and consumer loans, mainly in Singapore. OCBC has provided FY24e guidance for NIM to be at the higher end of 2.20% to 2.25%, with 1Q24 exit NIM currently at 2.27%.

The Negatives

– Allowances up 54% YoY, credit costs at 16bps. Total allowances rose 54% YoY to S$169mn mainly due to a rise in SPs to S$180mn (1Q23: S$56mn) offset slightly by GP write-back of S$11mn (1Q23: GP of S$54mn). As a result, total credit costs rose from 4bps YoY to 16bps. The uptick in SPs was due to several accounts in ASEAN with no systemic risk and no concentration in any particular sector or geography. Total NPAs were down 9% YoY to S$3bn as net recoveries/upgrades and write-offs more than offset new NPA formation, NPL ratio improved by 10bps YoY to 1.0%. OCBC has maintained their guidance for FY24e credit costs to be stable and come in between 20 to 25bps.

– Expenses continue to rise. Operating expenses rose 8% YoY to S$1.35bn, mainly from higher staff costs due to higher variable compensation associated with income growth. Nonetheless, 1Q24 cost-to-income ratio (CIR) was stable YoY at 37.1% as income growth outpaced the increase in expenses. OCBC is guiding for CIR of around 40 to 45% for FY24e as costs are expected to grow while income moderates, resulting in higher CIR.

Source: Phillip Capital Research - 13 May 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024