Trader Hub

Venture Corporation Limited – Worst Performance Since 2016

traderhub8

Publish date: Mon, 06 May 2024, 09:14 AM

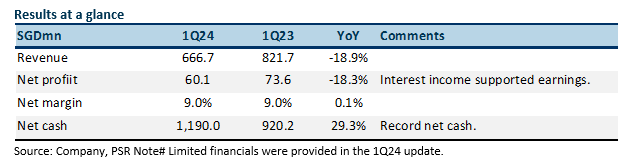

- 1Q24 results were within expectations. Both revenue and PATMI were 21% of our FY24e forecast. Net profit declined 18% YoY to S$60.1mn. We believe earnings were supported by strong interest income.

- Revenue in 1Q24 declined around 19% YoY to S$666.7mn, the weakest in eight years or 2016. The weakness was attributed to destocking in the life science, network, and communications segments.

- We maintain our FY24e earnings. We expect seasonality in demand to raise earnings sequentially in the coming quarters. Our NEUTRAL recommendation and target price of S$12.75, based on a 2-year historical PE ratio of 13x, is unchanged. The dividend yield of 5.6% is well supported by record net cash of S$1.19bn. Share buybacks is another avenue the company will pursue to return capital to shareholders.

The Positive

+ Cash piling up. Venture piles up net cash to record S$1.19bn (1Q23: S$920mn). Management said the cash improvement is due to working capital optimisation. We think it is also due to the lower sales performance. We believe the high cash levels is now the biggest growth driver with increased interest income.

The Negative

– Revenue plunging to 8-year lows. Revenue has dialled back down to 2016 levels. 1Q24 revenue of S$666.7mn is modestly above 1Q16 S$630.7mn. The near-term weakness was attributed to de-stocking in life science, network and communications segments.

Source: Phillip Capital Research - 6 May 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Trader Hub

CSOP IEdge S-REIT Leaders Index ETF – The Deeper Discounted Singapore REIT ETF

Created by traderhub8 | Jun 12, 2024

Valuetronics Holdings Ltd- Get Paid as Customer Base Is Refreshed

Created by traderhub8 | Jun 03, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments