DBS Group Holdings Ltd – NII and Fee Income Boost Earnings

traderhub8

Publish date: Fri, 03 May 2024, 10:18 AM

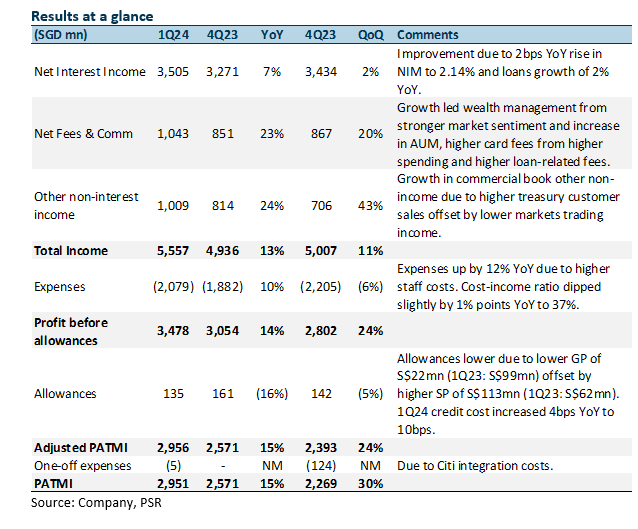

- 1Q24 adjusted PATMI of S$2.96bn was slightly above our estimates due to higher NII, fee income, and other non-interest income offset by higher expenses. 1Q24 adjusted PATMI is 28% of our FY24e forecast. 1Q24 DPS raised 29% YoY to 54 cents.

- NII rose 7% YoY on NIM expansion of 2bps and loan growth of 2% YoY. Fee income rose 23% YoY from WM and card fees, while other non-interest income grew 24% YoY. DBS has maintained its FY24e guidance of double-digit fee income growth (from wealth management and credit card fees) and credit cost of 17-20bps but increased its guidance for FY24e NII and PATMI to be above FY23 levels.

- Downgrade to ACCUMULATE with a lower target price of S$38.50 (prev. S$38.90) as we account for recent share price performance and 1-for-10 bonus share issue. We increased FY24e earnings by 2% as we increased NII estimates due to higher NIMs, fee income, and loan growth estimates. We assume a 1.83x FY24e P/BV and ROE estimate of 17.1% in our GGM valuation. Modest growth in NII from stable NIMs, low-single-digit loan growth, and double-digit growth in fee income will sustain earnings momentum.

The Positives

+ NII rises 7% YoY. NII rose 7% YoY to S$3.5bn due to a 2bps NIM increase to 2.14% (4Q23: 2.13%) as interest rates continue to remain high and loan growth grew modestly by 2% YoY. Loan growth came from higher non-trade corporate loans and the consolidation of Citi Taiwan. Management noted that loan growth was broad-based but was seen more in Singapore and India, which was offset by Hong Kong loans shifting to mainland China.

+ Fee income continues to recover. Fee income rose 23% YoY to a record level of S$1,043mn. The growth was led by wealth management (WM) fees surging 47% YoY from stronger market sentiment and an increase in assets under management (AUM). Card fees rose 33% YoY from higher spending, while loan-related fees grew 30% YoY. The consolidation of Citi Taiwan benefitted both WM and card fees. This was offset slightly by a decline in investment banking fees (-59% YoY) due to slower capital market activities while transaction services were flat YoY.

+ Other non-interest income rose 24% YoY. This growth was mainly due to higher treasury customer sales, partially offset by a decline in market trading income from higher funding costs. Notably, commercial book continues to account for the majority of other non-interest income at 62% (1Q23: 53%), while treasury markets account for 38% (1Q23: 47%).

The Negatives

– SPs and NPAs rise YoY. SPs rose 82% YoY to S$113mn, while new NPAs rose 45% YoY to S$317mn from broad-based increases across all sectors. As a result, credit costs rose from 4bps YoY to 10bps. DBS has mentioned that the NPA formation was idiosyncratic, and they do not see particular stress in any sector. Nonetheless, 1Q24 total allowances were lower by 16% YoY as the higher SP was more than offset by a lower GP of S$22mn (1Q23: S$99mn). The NPL ratio was flat at 1.1% (4Q22: 1.1%), while GP reserves grew 4% YoY to S$3.93bn. Notably, management mentioned ~S$2bn of management overlay, which could be released if SP comes in higher than expected.

– The decline in the CASA ratio continues. The Current Account Savings Accounts (CASA) ratio fell 6% points YoY to 51%, mainly due to the high-interest rate environment and a continued move towards fixed deposits (FDs). The declining CASA ratio could further increase funding cost and there could be an increased dependence on FDs, which usually comes at a higher interest rate. Nonetheless, total customer deposits grew 3% YoY to S$547bn as the decline in CASA deposits was offset by growth in FDs and a contribution of S$12bn from the Citi Taiwan consolidation.

Source: Phillip Capital Research - 3 May 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024

calvintaneng

DBS best investment will be buying Tsh Resources shares

Tsh own 80,000 acres of very prime lands in Bongan, Kutai West (only 43.9km) from Titik Nol Ikn Nusantara

distance of Sentosa Island to Paradigm Mall in Johor

Cost and book value only Rm4500 to Rm7000 an acre

today asking prices there in millions ringgit value per acre

Better not miss Tsh Resources

now only 32.5 sen

long term will reach $S1.00 when Development spreads out from Ikn Nusantara to these prime lands

2024-05-05 20:08