Cromwell European REIT – Asset Rejuvenation Strategy to Drive Organic Growth

traderhub8

Publish date: Mon, 01 Apr 2024, 11:25 AM

- Resilient portfolio in terms of portfolio occupancy (FY23: 94.3%) and rent reversions (FY23: +5.7%). Occupancy is expected to remain stable this year, with only 13.5% of portfolio leases due for renewal.

- CERT’s long-term 60:40 target asset class split between light industrial / logistics and well-located Grade A offices stands to benefit from the growth in e-commerce and the nearshoring trend, as well as flight to quality.

- Divested €237mn at a 14.6% premium. Another €170mn of assets remaining that are earmarked for sale. The loss of income from divestments and redevelopments is a near-term softness but will keep gearing at their target range of 35-40%. We initiate coverage with a BUY recommendation on Cromwell European REIT with a DDM-derived target price of €91. The FY24e forward dividend yield is 10% based on the current share price. CERT is trading at a P/NAV of 0.65x.

Company Background

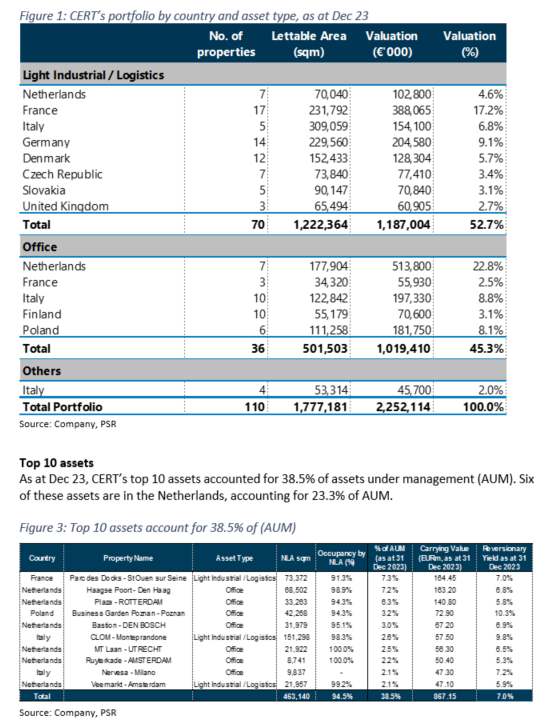

Cromwell European REIT (CERT) was listed on the SGX in Nov 2017. Its €2.3bn portfolio comprises 110 predominantly freehold properties in or close to major gateway cities in the Netherlands, Italy, France, Poland, Germany, Finland, Denmark, Slovakia, the Czech Republic, and the UK, with an aggregate lettable area of c.1.8mn sq m and over 800 tenant-customers. CERT’s portfolio consists predominantly of light industrial/logistics (53%) and office (45%) assets. It is managed by Cromwell EREIT Management Pte. Ltd., a wholly owned subsidiary of CERT’s sponsor, Cromwell Property Group, a real estate investor and manager with operations in 14 countries and is listed on the ASX.

Key Investment Merits

- Resilient portfolio with high occupancy and rent reversions. As at Dec 23, portfolio occupancy remained high at 94.3% (Dec 22: 96%) despite the challenging economic environment. Portfolio occupancy is expected to remain stable in 2024, with only 13.5% of leases due for renewal. CERT observed its sixth consecutive half of positive rent reversions, with FY23 reversions coming in at 5.7%. This was due to positive reversions from both the light industrial/logistics (FY23: 3.7%) and office (FY23: 7.5%) segments.

- Divestments to keep capital management in check. Since FY22, CERT has made eight divestments for €237mn at a blended 14.6% premium to the most recent valuation – of which three were divested in FY23 for €196.5mn at a blended 13.6% premium. CERT has €170mn of assets remaining that are earmarked for sale, with most coming from the weaker Polish and Finnish office assets. The proceeds from the divestments could either be used to pay off debt to lower interest costs and keep gearing within the management target range of 35-40% or to recycle capital into accretive redevelopments of some of CEREIT’s trophy projects. The successful divestments in the weaker Polish and Finnish office assets would also bring CERT closer to its long-term 60% light industrial/logistics target weightage to capitalize on the growth of e-commerce and nearshoring.

- CPI-indexed rental escalations. Most of CERT’s leases contain annual rental escalation clauses that are based on 100% of the YoY increase in CPI except for leases in Italy, where it is based on 75% of the YoY increase in CPI. This will help CERT tide through difficult periods of high inflation.

We initiate coverage on Cromwell European REIT with a BUY rating and a DDM-derived target price of €1.91, based on a COE of 10.2% and a terminal growth rate of 2%. We forecast a DPU of 13.76 cents for FY24e, translating into a forward yield of 10%.

Background

Cromwell European REIT (CERT) was listed on the SGX in Nov 2017. It has a principal mandate to invest, directly or indirectly, in income-producing real estate assets across Europe that are used primarily for light industrial/ logistics and office purposes. Its €2.3bn portfolio comprises 110 predominantly freehold properties in or close to major gateway cities in the Netherlands, Italy, France, Poland, Germany, Finland, Denmark, Slovakia, the Czech Republic, and the UK, with an aggregate lettable area of c.1.8mn sq m and over 800 tenant-customers. CERT’s portfolio consists predominantly of light industrial/logistics (53%) and office (45%) assets. It is managed by Cromwell EREIT Management Pte. Ltd., a wholly owned subsidiary of CERT’s sponsor, Cromwell Property Group, a real estate investor and manager with operations in 14 countries and is listed on the ASX.

Source: Phillip Capital Research - 1 Apr 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024