Thai Beverage PLC – No Celebrations, Yet

traderhub8

Publish date: Thu, 15 Feb 2024, 05:12 PM

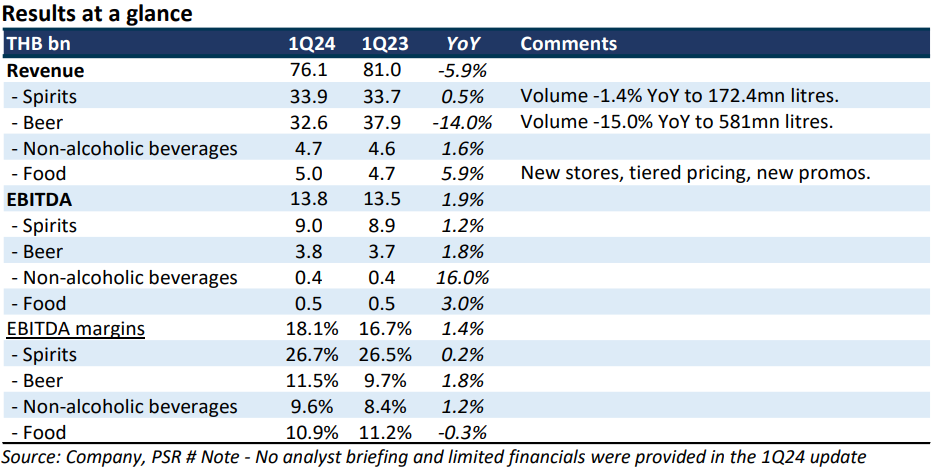

- Results were within expectations. 1Q24 revenue and EBITDA were at 26%/27% of our FY24e forecasts. 1Q24 EBITDA rose 1.9% YoY to Bt13.8bn.

- 1Q24 beer revenue suffered a 14% YoY decline in revenue, consistent with the 15% drop in volumes. Spirits operations were stable with revenue largely flat YoY. Margins for both businesses rebounded on lower production costs and marketing spend.

- We maintain our FY24e forecasts. Our BUY recommendation and target price of S$0.75 is unchanged. We peg our target price to 16x FY24e core earnings, the 3-year historical average. Listed associates are valued at market valuations. We remain positive on the recovery of volumes this year as economic conditions improve via government stimulus and a rebound in exports.

The Positive

+ Margin improvement. There was margin improvement, especially in the beer segment. We believe the improvement came largely at Sabeco through a combination of lower production costs and more disciplined spending on advertising and printing. Spirits margins were stable as the product mix of higher-margin brown spirits rose.

The Negative

– Volumes still falling for beer. Beer volumes were down in the teens for the past four quarters with the sharpest decline in 1Q24. For calendar 2023, volumes were down 12% YoY, only 4% points lower than the 16% drop in pandemic hit 2020. The slowdown in macro conditions in Vietnam has hurt consumption spending and distributor confidence to stock up.

Outlook

Recovery in 2024 highly depends on the strength of Thailand’s and Vietnam’s economies. We believe there is room for optimism in Thailand with planned fiscal stimulus, a cut in excise tax for spirits (from 10% to 0%), and the possible removal of prohibited periods (2 pm-5 pm) to sell alcohol. We do expect a slower recovery in Sabeco. Tet sales in Vietnam appear to be sluggish, with dealers and supermarkets being more cautious in building up inventory. Competition in prices and giveaways remains intense.

Maintain BUY with unchanged TP of S$0.67

Our target price is maintained at S$0.67. Valuations are based on a 3-year historical average of 16x PE and listed associates are valued at a 20% discount to current market prices.

Source: Phillip Capital Research - 15 Feb 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024