BRC Asia – Construction Progress to Gather Speed

traderhub8

Publish date: Wed, 06 Dec 2023, 11:13 AM

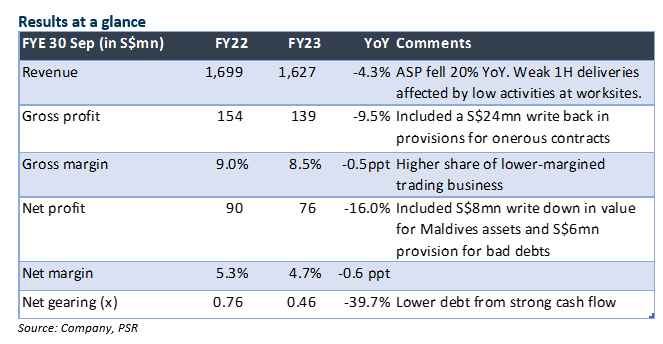

- FY23 net profit was 14.8% above our expectations due to S$24mn write-back in provisions for onerous contracts, offset by S$8mn write-down in value of its Maldives hospitality asset and S$6mn provisions for impairment/fair value loss on trade receivables.

- Net profit declined 16.0% YoY, due to 20% YoY fall in ASP (our estimate) and lower volume in 1H23 as customers faced safety measures and manpower constraints. 2H23 net profit was flat YoY. Demand remains strong, led by public sector jobs.

- Maintain BUY with unchanged TP of $1.99. We think the ASP has bottomed and will remain stable. We estimate volume could rise by 20% in FY24e as the construction sector plays catch up. We raise FY24e net profit forecast by 5.6% on less funding cost on improved gearing.

The Positives

+ Revenue and net profit rebounded in 2H23, after a weak 1H when sales of steel products were curtailed by safety rules imposed at construction sites. 2H23 revenue and net profit were flat YoY, despite the ASP decline of 27% YoY (our estimate), implying strong volume recovery.

+ Gross margin was lower (-0.5% pt to 8.5%) due to higher share of lower-margined trading business (25% of revenue). We expect it to recover to 9% in FY24e when fabrication and manufacturing volume rises. Demand for steel products remains strong. BRC’s orderbook of S$1.3bn is underpinned by mainly public sector projects.

+ Net gearing improved to 0.5x (Sep 22: 0.8x) from strong operating cash flow. EBITDA to interest expense improved to 1.5x (FY22: 2.3x).

The Negative

– nil

Outlook

Net profit growth is expected to resume with a stable ASP and stronger order deliveries. Construction demand is expected to remain robust, led by public housing, record government land sale programmes and infrastructure projects.

Maintain BUY with unchanged TP of $1.99

BRC trades at an attractive 8.9% dividend yield and 1x P/B for FY24e.

Source: Phillip Capital Research - 6 Dec 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024