Sasseur REIT – Record Occupancy and Robust Outlet Sales

traderhub8

Publish date: Mon, 13 Nov 2023, 11:35 AM

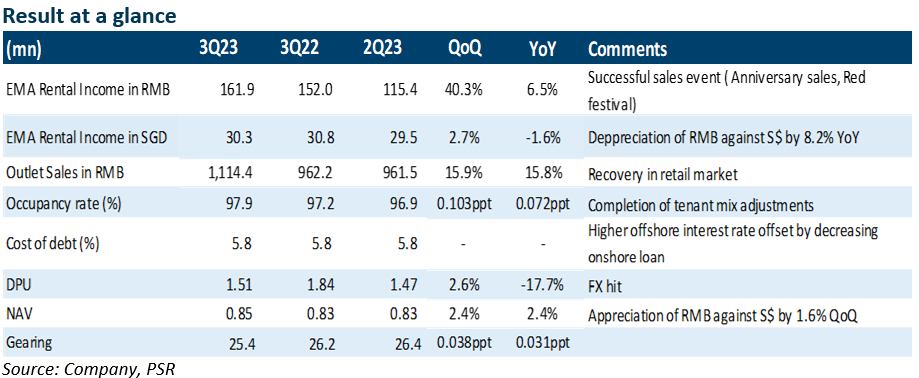

- 3Q23 results were within expectations. 9M23 rental income in SGD/RMB terms was 75%/75% of our FY23e estimates. No change in SASSR’s FY23 guidance.

- Outlet sales in 3Q23 surged 15.8% to RMB1.1bn due to the success of a series of sales events. EMA rental income was lifted by 6.5% YoY in RMB terms. Depreciation of RMB by 8.2% YoY and higher financing cost continue being a drag for SASSR.

- EMA rental income for 3Q23 in SGD terms slid by 1.5% YoY, and DPU decreased by 17.7% (S$1m one-time tax refund in 3Q22; without that, DPU would be down 9.7% YoY). 9M23 DPU of S$4.834 cents was in line with our expectations and formed 75% of our FY23e forecast.

- We reiterate our BUY recommendation with an unchanged DDM TP of S$0.9. We expect the strong value offers to offset the seasonal weakness in 4Q23 and achieve full-year sales growth of 29%. FY23e-FY24e DPU forecast is for 6.45 – 6.61 Singapore cents.

The Positives

+ 3Q23 outlet sales up 15.8% (RMB 1.11bn) on the back of successful promotional events. Sales for Kunming increased by 25.5% QoQ in the face of completion of tenant rebalancing. Chongqing Liangjiang is still the proxy of retail recovery with YoY improvement of 19.2% and contributing to 57.4% of total sales.

+ The portfolio occupancy achieved a record high of 97.9% (+0.7% YoY). Chongqing Liangjiang remained at 100% occupancy, while the other 3 outlets were above 96%. In 3Q23, a total of 300 new leases were signed, including the 1,152 sqm superstore in Hefei, which had been vacant for 7 years. This strategic move aims to tap into the market catchment of 150,000 residents.

The Negatives

– Depreciation of renminbi could erode DPU further. The renminbi weakened by 8.2% YoY against the Singapore dollar. Despite the 1.2% QoQ improvement, we remain mindful of the risks posed by six consecutive declines in exports, which could lead to further RMB depreciation. SASSR has been hedging its revenue for 3-6 months, and we anticipate some exchange gains to be realized by the end of the year to mitigate this.

Outlook

The management expressed confidence that strong offline sales is less likely to be derailed by e-commerce and streaming in China. SASSR is also onboarding more F&B and Sports tenants to cope with the structural shift in the outlet mall industry towards more experiential. Despite the typical seasonality, we expect that sales in 4Q23 will be on par with 3Q23 as a result of tenancy optimization. Furthermore, SASSR has guided that the cost of debt is expected to be c.5.5-6% in FY24e. Further interest rate cuts are anticipated, which should help mitigate the impact of overseas monetary tightening. Offshore loans account for 46.4% of the total borrowing and 77% is hedged in fixed rate. Meanwhile, as the Singapore dollar could stay strong against RMB in 2H23, we anticipate a temporary DPU growth pothole for FY23 as a result.

Maintain BUY with unchanged TP to S$0.90

SASSR is currently trading at FY23e yields of 9.63%. We project a sales growth of 29% YoY, capitalising on SASSR’s distinct value proposition amid the consumption decline in China. Our DDM-TP of S$0.90 remains unchanged, with expected FY23-24e DPUs of 6.45 – 6.61 Singapore cents.

Source: Phillip Capital Research - 13 Nov 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024