CapitaLand Investment Limited – Growing Recurring Income Streams

traderhub8

Publish date: Mon, 13 Nov 2023, 11:32 AM

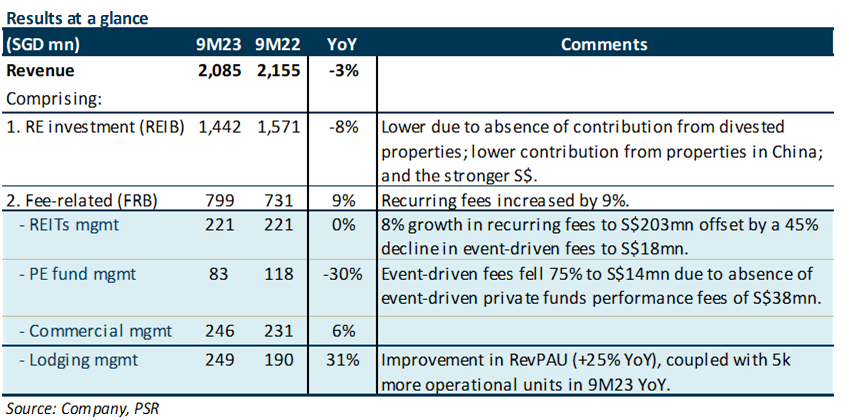

- 9M23 revenue of S$2.085bn (-3% YoY) was slightly below our estimates, forming 69% of our FY23e forecast.

- Fee-related revenue is on the rise, driven by a 31% increase in lodging management fees and a 9% growth in recurring fund management fees. However, this is offset by a significant decrease of 64% in event-driven fees. Including embedded funds under management (FUM) of S$10bn that is pending deployment, CLI has reached its 2024 FUM target of S$100bn. Total recurring income for 9M23 grew by 9% YoY.

- Maintain BUY with an unchanged SOTP TP of S$3.68. No change in our estimates. Our SOTP-derived TP of S$3.68 represents an upside of 25.3% and a forward P/E of 18x. We like CLI for its robust recurring fee income stream and asset-light model. We expect the lodging business to continue to improve with higher RevPAU (9M23: +25%) and more lodging units turning operational (>20 properties to be opened in 4Q23).

The Positives

+ Lodging segment star performer. 3Q23 RevPAU up 15% YoY, attributed to higher occupancy (+7ppts) and ADRs (+3%). Overall RevPAU stood at 107% of pre-COVID 3Q19 levels. The improvement in operating performance coupled with 6,200 units (3.8% of signed units) turning operational resulted in a 31% YoY growth in lodging management fees. CLI has a target to reach S$500mn in lodging management fees within five years.

+ Recurring fund management fees grew 9% YoY to S$272mn in 9M23. This alleviates the impact of lower event-driven fees (-64% YoY) in a market that is less conducive for deal-making. CLI has c.S$10bn in embedded FUM that could lift fee income if deployed; it has a current FUM of S$90bn (FY22: S$88bn).

+ Active capital raising. CLI raised S$3.5bn of capital for its private funds YTD (42% above total raised for FY22). During the quarter, it launched a new Wellness and Healthcare-related Fund with an initial close of S$350mn – it has a target fund size of S$500mn with an option to upsize to S$1bn. In 3Q23 to date alone, it has raised S$1.7bn and is looking at strong growth opportunities in SE Asia and India to deploy capital.

The Negative

– China remains a drag. Despite improvements in shopper traffic (+34% YoY) and tenant sales (+22% YoY), retail rental reversions continue to be negative. Office rental reversions were mildly negative, with only new economy assets having mildly positive rental reversions.

– Expect portfolio valuation declines at year end. Due to higher interest rates and cap rate expansion, valuation declines are expected in Australia, Europe, UK and USA. Valuations in China are also expected to decline due to the softer economic outlook in China, while valuations in Singapore and India are expected to be stable.

Outlook

CLI’s lodging management business should continue to remain strong on the back of higher travel demand. We expect event-driven fee-related income to improve in FY24 as interest rate stabilises. Deployment of capital under embedded FUM remains slow, but we expect it to pick up in 2H24. As only 64% of debt is on fixed rate, CLI could continue to be impacted by higher interest rates (+0.1ppts QoQ to 3.9% in 9M23). CLI has a current gearing of 0.55x, up from 0.52x as at end Dec22.

CLI has divested S$1.2bn of assets YTD, and it is unlikely to hit its S$3bn divestment target for FY23. It has c.S$10bn of assets in the divestment pipeline, with almost half of it coming from China.

Maintain BUY with an unchanged TP of S$3.68. No change in our estimates. Our SOTP-derived TP represents an upside of 25.3% and a forward P/E of 18x.

Source: Phillip Capital Research - 13 Nov 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024