Valuetronics Holdings Ltd- Returning to Growth, Trading Around 90% Cash

traderhub8

Publish date: Mon, 13 Nov 2023, 11:30 AM

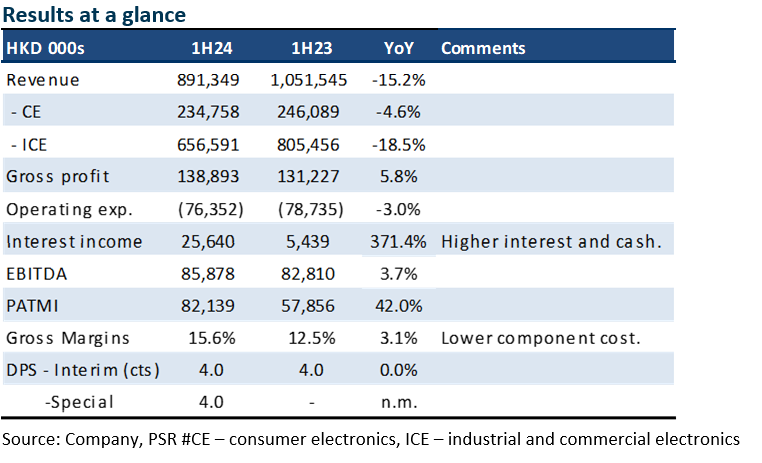

- 1H24 PATMI grew 42% YoY to HKD82.1mn, and above our expectations. Revenue and PATMI were 42%/62% of our FY24e estimates. Revenue decline was due to lower component prices. The company announced a special dividend of HKD4 cents in addition to interim HKD4 cents.

- Earnings growth was driven by (i) gross margin expansion from lower component prices and a weaker renminbi; (ii) an increase in interest income; and (iii) lower operating expenses, especially depreciation.

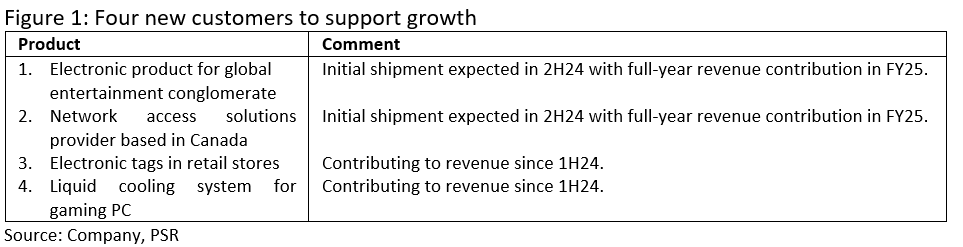

- We raise our FY24e PATMI forecast by 15% and maintain our BUY recommendation. Our target price is raised from S$0.61 to S$0.70. We peg our target price to the industry valuation at 11x PE. With the current cash hoard of HKD1.143bn (or S$199mn), around 90% of the market capitalisation is net cash. There is visibility of earnings growth over the next two years as Valuetronics’ four new customers ramp-up production. The company trades at a dividend yield of 6% and has an outstanding share buyback plan of HKD182mn (or approx. 58mn shares at current share price).

The Positives

+ Recovery in margins. There were several drivers for the improvement in margins, namely, lower renminbi, reduction in staff, decline in depreciation and fall in component cost. Despite the increase in capex over the past three years, depreciation fell as most of the spending was on property and fittings which have a slower depreciation rate than equipment.

+ Unprecedented special dividend after interim results. The company announced a HKD4 cents special dividend in addition to the interim HKD4 cents. Valuetronics generated HKD179mn of free cash flow in 1H24 (1H23: HKD112mn), adding to their cash hoard of HKD1.143bn.

The Negative

– Decline in revenue. ICE segment registered an 18.5% decline in revenue. A large reason for the decline was lower component prices rather than weak demand. During the component shortages a year ago, some components had to be purchased at exorbitant spot prices on cash terms that were reimbursed by customers. The supply chain or lead times have normalised.

Outlook

We expect a stronger 2H24. Revenue growth will come from the four new customers (Figure 1) announced by the company. Margin expansion is expected to continue from a higher mix of ICE products, increased volumes and weak renminbi.

Maintain BUY with a higher TP of S$0.70 (prev. S$0.61)

Our target price is based on industry valuations of 11x PE 1-year forward earnings.

Source: Phillip Capital Research - 13 Nov 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024