Prime US REIT – Challenges Remain, But Manageable

traderhub8

Publish date: Thu, 09 Nov 2023, 11:37 AM

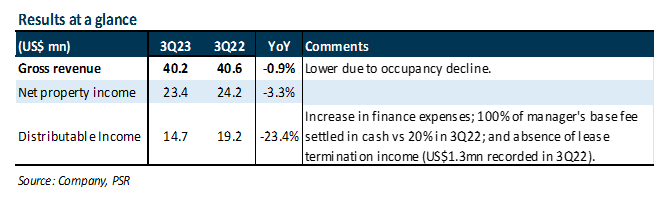

- 3Q23 distributable income of US$14.7mn (-23.4% YoY) was in line with our expectations and formed 25% of our FY23e forecast. The YoY decline was due to Prime increasing management fees paid in cash from 20% to 100%, higher interest expense, lower portfolio occupancy, and absence of lease termination income (US$1.3mn recorded in 3Q22). Excluding the change in management fees paid in cash, distributable income is down 16.6% YoY.

- Portfolio occupancy dropped to 85% from 85.6% in 2Q23, with overall rental reversions of -2%. Prime is prioritising net effective rents (deals with lower capex) over headline rents in this challenging US office environment in a bid to shore up occupancy.

- Maintain BUY, DDM-TP lowered from US$0.39 to US$0.37. FY24e DPU lowered by 7% on lower occupancy and higher finance costs assumptions. Prime is currently trading at 0.21x P/NAV. We believe that most of the negatives are already priced in. The key risk will be on the year-end valuation impact to gearing (43.7%) and bank covenants. There is a refinancing of US$484mn (69% of total) debt under its main credit facility which expires in July 24. The current share price implies FY23e/FY24e DPU yield of 30%.

The Positive

+ Leasing activities picked up in 3Q23. Prime signed 145.6k sq ft of leases in 3Q23, more than the previous two quarters combined (1H23: 131.2k sq ft). This was mainly due to the lease extension of top tenant Charter Communications for 94k sq ft at Village Center Station I (VCS I). Management indicated strong leasing momentum at some of its properties, with notable leasing discussions underway at VCS I and Park Tower, albeit with relatively longer lead times. One of its top 10 tenants, Matheson Tri-Gas, has indicated interest to expand its space at Tower 909, and discussions are ongoing.

The Negatives

– Portfolio occupancy dipped from 85.6% to 85% QoQ. We expect further decline in occupancy going forward as Sodexo, Prime’s second largest tenant (5.3% of income), vacates One Washingtonian Center (OWC). It will vacate 166k sq ft of 191k sq ft leased by Dec 2023 – the balance space is currently sublet to other tenants who will likely remain. Prime is making use of this downtime to re-amenitize OWC, with enhancement initiatives costing c.US$5mn underway to modernize the asset to improve leasing interests. Backfilling at this asset is in progress, with encouraging signs as it has already secured a 19k sq ft 11-year lease with a healthcare tenant in Oct 23.

– Gearing increased 0.9ppts QoQ to 43.7%, leaving a c.12.9% buffer from FY22 year-end valuations before it reaches 50%. 78% of debt is either on fixed rate or hedged (2Q23: 80%), with 62% of debt hedged or fixed through to 2026 or beyond. The remaining 16% of hedges expire in July 24. Prime’s YTD all in interest cost rose to 4% from 3.9% in 1H23, and its interest coverage ratio is at 3.2x. Prime is in talks with lenders to refinance US$484mn (69% of total) debt that expires in July 24.

Source: Phillip Capital Research - 9 Nov 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024