Baltic Exchange Shipping Updates: Dec 6, 2024

edgeinvest

Publish date: Tue, 10 Dec 2024, 09:56 AM

A weekly round-up of tanker and dry bulk market (Dec 6, 2024)

The Baltic Exchange, a wholly-owned subsidiary of Singapore Exchange, is the world's only independent source of maritime market information for the trading and settlement of physical and derivative contracts.

Its international community of over 650 members encompasses the majority of world shipping interests and commits to a code of business conduct overseen by the Baltic.

For daily freight market reports and assessments, please visit www.balticexchange.com.

Capesize

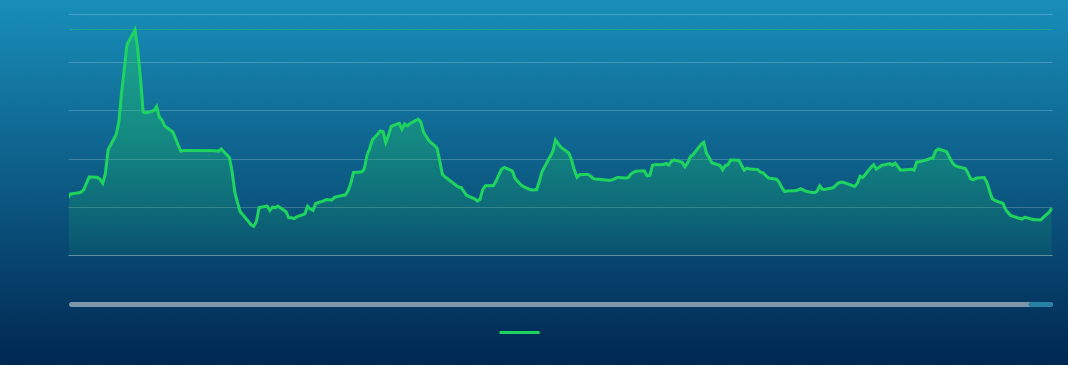

The Capesize market faced a challenging week, with the BCI 5TC steadily declining, shedding US$3,909 across the week to close at US$12,727, reflecting subdued sentiment and oversupply of tonnage in both basins. While the Pacific saw intermittent injections of fresh cargo, oversupply of tonnage persistently weighed on rates, with the C5 index dropping from US$8.705 on Monday to end the week at US$7.415. Limited fixtures from West Australia to China underscored the subdued activity, despite occasional support with coal cargoes from East Australia. The Atlantic market struggled similarly, particularly the South Brazil and West Africa to China markets, where muted demand and an oversupply of ballasters weighed on rates. The C3 index fell from US$19.19 to end the week at US$17.48. However, as the week draws to a close, brokers observed some resistance from Owners on C3, while the North Atlantic displayed signs of a potential recovery. Slightly firmer fixtures began to emerge, hinting at possible upside.

Panamax

Mid-week saw life injected into the market across most areas of the Atlantic. Decent levels of both grain and mineral demand added some impetus to a stagnant market and small gains were witnessed. A mini-rally emerged ex South America with improved offers being hit for end-December arrival dates in which many felt would seep into January arrival rates but has yet to be fully tested, with US$14,500+US$450,000 delivery load port arguably the highlight this week on a decent spec 82,000dwt for end-December arrival. From Asia, little excitement as limited fresh enquiry from both Australia and NoPac came into play, but the market was said to have found something a floor as the week concluded. An 82,000dwt delivery Korea was reported fixed at US$11,000 for a NoPac round trip with grains. Period action was limited, although reports emerged of a new building 82,000dwt delivery ex yard China fixing at US$14,250 basis 10/15 months.

Ultramax/Supramax

Another rather protracted week for the sector as rates across most areas struggled to gain any positive momentum. In the Atlantic, both the north and south lacked much fresh impetus. Brokers said little demand was seen from the south however there was a plentiful supply on tonnage. From the US Gulf a rather uneventful week, a 56,000dwt was fixed delivery Port Arthur for a short trip to Spain at US$20,000. Demand from the Mediterranean waned, a 63,000dwt fixing delivery Damietta redelivery EC South America at US$6,000. From the Asian arena, it is a similar story as vessel availability was easily sufficient to keep up with demand. From the north, a 64,000dwt fixed delivery CJK for a NoPac round redelivery Philippines at US$11,000. Further south, a 56,000dwt fixed delivery Singapore via Indonesia redelivery SE Asia at US$12,000. The Indian Ocean was described as positional, a 64,000dwt fixed delivery Chittagong trip via EC India redelivery China at US$10,000. With the festive season fast approaching it will be interesting to see what happens next.

Handysize

It's been a challenging week for the sector, with rates in both the Atlantic and Pacific regions continuing to face downward pressure. Across the Continent and Mediterranean, the market showed a lack of fresh impetus with overall sentiment remaining positional. Rates continued to hover around the last done. A 32,000dwt was fixed for delivery aps Canakkale on a trip via Turkey to Goa, redelivering in Bangladesh at US$9,500. In the South Atlantic, market fundamentals remained relatively unchanged, with transatlantic cargoes continuing to be the main driver for the region. A 37,000dwt vessel, open in Salvador between 25/27 November, was fixed for delivery aps Recalada for a trip to West Coast South America at US$21,000. However, the US Gulf market was very quiet, primarily due to the Thanksgiving holiday festivities, with little fixing activity reported. Charterers have been bidding lower than previously agreed levels. A 38,000dwt fixed delivery SW Pass to redelivery West Coast with grains at US$14,750. In the Pacific, challenges persist with rising free tonnages and limited cargo availability. However, some sources suggest that the market may have reached its bottom, with no further significant rate drops expected. A 28,000dwt vessel was fixed for delivery dop Vancouver to redelivery Japan with petcoke at US$13,000.

Clean

LR2

Following last week’s improvements, LR’s in the MEG stalled and lost steam this week. TC1 75kt MEG/Japan eased down 8.56 points to WS111.72 and a trip westerly on TC20 90kt MEG/UK-Continent the index held stable around the US$3.4 million mark.

West of Suez, Mediterranean/East LR2’s on TC15 plateaued after ticking over the US$3 million level at US$3.09 million.

LR1

I In the MEG, LR1’s remained flat this week. TC5 55kt MEG/Japan held stable in the WS110-112.5 region. Conversely, a run to the UK-Continent on TC8 65kt MEG/UK-Continent dipped from US$2.7 million to US$2.54 million.

On the UK-Continent, the TC16 60kt ARA/West Africa index held resolute around WS120 this week.

MR

MR’s in the MEG climbed optimistically this week. The TC17 35kt MEG/East Africa index, as a result, climbed up to WS198.57 from WS180 after a widely reported fixture mid-week at around WS195.

UK-Continent MR’s dipped early in the week only to rebound swiftly. The TC2 index 37kt ARA/US-Atlantic coast dropped from WS128.75 to then return just as dramatically to WS126.88. TC19 37kt ARA/West Africa followed the same pattern and is currently pegged at WS170 up from WS159.38 5 days ago via a stop at WS148.75.

MR’s in the USG resurged with gusto this week. TC14 38kt US-Gulf/UK-Continent was assessed 20.35 points higher by the end of the week at WS158.21. TC18 38kt US Gulf/Brazil index climbed 22.15 points to WS224.29. A local voyage on TC21 38kt US-Gulf/Caribbean also jumped up 65% to US$802,857.

The MR Atlantic Triangulation Basket TCE gained US$4,357 to US$27,045.

Handymax

In the Mediterranean, Handymax’s yoyoed with TC6 crashing from WS216.11 to WS150 over a three-day period to then recorrect back up to WS172.22 at time of writing. Up on the UK-Continent, the TC23 30kt Cross UK-Continent index came back under pressure and dropped from WS178.89 to WS149.72 this week.

VLCC

The VLCC market continued the downward trajectory this week. The 270,000mt Middle East Gulf to China trip (TD3C) dipped a further two points to WS43.35 which gives a daily round-trip TCE of US$21,967 basis the Baltic Exchange’s vessel description. In the Atlantic market, the rate for 260,000mt West Africa/China (TD15) lost three more points to WS49.39 (corresponding to a round voyage TCE of US$29,104 per day), while the rate for 270,000mt US Gulf/China (TD22) dropped by US$146,667 to US$7,170,000 (a daily round trip TCE of US$33,638).

Suezmax

Owners continued applying pressure on charterers this week. In West Africa, the 130,000mt Nigeria/UK Continent voyage (TD20) rose six points to WS92.06, meaning a daily round-trip TCE of US$34,748. The TD27 route (Guyana to UK Continent basis 130,000mt) climbed 13 points since Wednesday 27th November to WS90.56 which translates into a daily round trip TCE of US$33,627 basis discharge in Rotterdam, helped in the main by a rising Aframax market in the US Gulf region. For the TD6 route of 135,000mt CPC/Med, the rate remained flat at the WS100 level (showing a daily TCE of US$35,554 round-trip). In the Middle East, the rate for the TD23 route of 140,000mt Middle East Gulf to the Mediterranean (via the Suez Canal) hovered around the WS92 mark.

Aframax

In the North Sea, the rate for the 80,000mt Cross-UK Continent route (TD7) remained around the WS125 level (giving a daily round-trip TCE of US$30,213 basis Hound Point to Wilhelmshaven).

In the Mediterranean market the rate for 80,000mt Cross-Mediterranean (TD19) eased by 2.5 points to WS143.11 (basis Ceyhan to Lavera, that shows a daily round trip TCE of US$37,910).

Across the Atlantic, after the Thanksgiving weekend, rates turned and rocketed upwards. Since Wednesday 27th November, rates for the 70,000mt East Coast Mexico/US Gulf route (TD26) and the 70,000 mt Covenas/US Gulf route (TD9) have risen 80 points to WS175-176 region, showing a daily round-trip TCE of US$41,325 and US$45,711, respectively. The rate for the trans-Atlantic route of 70,000mt US Gulf/UK Continent (TD25) has climbed 72 points to WS191.89 (a round trip TCE basis Houston/Rotterdam of US$48,443 per day).

LNG

The LNG spot market continued to stagnate this week, with rates remaining relatively flat amid limited activity. In the Pacific, the double hit of lengthy tonnage lists and elusive cargo opportunities are putting pressure on rates. The BLNG Australia-Japan route for 174k cbm 2-stroke vessels edged up slightly by US$200 to US$26,000. Meanwhile, the 160k cbm TFDE vessels saw no movement, holding steady at US$16,000. With little new enquiry and most activity centred on the Trans-Atlantic market, expectations of any significant rate increases remain low.

The US market displayed more activity this week, with a few vessels put on subs for late-December cargoes, likely destined for Europe rates lifted slightly. The BLNG2 Houston-Isle of Grain route for 174k cbm 2-stroke vessels rose by US$3,700 to US$21,100, while the 160k cbm TFDE index mirrored this movement, climbing to US$13,800. Conversely, the BLNG3 Houston-Japan route remained subdued, reflecting the muted intra-basin activity and continued challenges in the Pacific market. Rates rose modestly, more due to upward pressure from BLNG2 than actual fixing activity. The 174k cbm 2-stroke index gained US$1,000 to publish at US$28,200, while the 160k cbm TFDE index rose by US$2,500 to US$17,800.

The period market remains largely inactive, with most discussions shifting toward index-linked charters, if they are taking place at all. With rates so low, owners are hesitant to commit to deals anywhere from multi-month charters to terms of up to three years. The Baltic six-month period index published at US$27,350, while the one-year term dropped to US$37,550. The three-year period showed the most significant decline, falling by US$2,650 to US$55,350.

With limited Pacific activity and slight improvements in the Atlantic, the market remains subdued overall. Rate movements will likely depend on further developments in US-Europe trade and any significant changes in Pacific cargo activity.

LPG

The LPG market continued its subdued performance this week. Following two weeks of inactivity, the Middle East Gulf (MEG) BLPG1 Ras Tanura-Chiba Baltic route saw only a single reported fixture, originating from India. As a result, rates remained largely stagnant, declining by just US$0.16. The Baltic published BLPG1 at US$50.333, reflecting a slight drop in daily TCE earnings to US$31,376, down by only US$208 for the week.

In the Atlantic, activity picked up slightly, but with the tonnage list beginning to grow, a bearish sentiment appeared to influence the market. The Baltic BLPG3 Houston-Chiba route dropped by US$4.50, settling at US$100.833. This corresponded to a daily TCE earning of US$37,535. Meanwhile, BLPG2 Houston-Chiba saw no reported fixtures; its rates moved in tandem with the BLPG3 print, falling by US$3 to close the week at US$55.75, with a daily TCE earning of US$54,270.

While the MEG market remains flat, the Atlantic's growing tonnage and declining rates hint at potential further bearish trends in the coming weeks.

Disclaimer:

While reasonable care has been taken by the Baltic Exchange Information Services Limited (BEISL) and The Baltic Exchange (Asia) Pte. Ltd. (BEA, and together with BEISL being Baltic) in providing this information, all such information is for general use, provided without warranty or representation, is not designed to be used for or relied upon for any specific purpose, and does not infringe upon the legitimate rights and interests of any third party including intellectual property. The Baltic will not accept any liability for any loss incurred in any way whatsoever by any person who seeks to rely on the information contained herein.

All intellectual property and related rights in this information are owned by the Baltic. Any form of copying, distribution, extraction or re-utilisation of this information by any means, whether electronic or otherwise, is expressly prohibited. Persons wishing to do so must first obtain a licence to do so from the Baltic.

Source: TheEdge - 10 Dec 2024

More articles on CEO Morning Brief

Created by edgeinvest | Jan 10, 2025

Created by edgeinvest | Jan 07, 2025